Handy

Handy is a Uruguayan fintech company specializing in electronic payment solutions for small and medium-sized enterprises (SMEs).

Handy, a Uruguayan fintech company, has become a significant provider of electronic payment solutions for small and medium-sized enterprises (SMEs) in Uruguay. Founded by the PE firm InCapital, Handy stands out as a cloud-native company utilizing AWS to support its digital payment infrastructure. In 2023, Itaú Unibanco acquired a 40% stake in Handy, reflecting its strategic focus on enhancing digital inclusion in Uruguay.

Martín Guerra, founding partner of Handy said in the interview with time News, “We created this venture in 2021 upon seeing the enormous difficulty that SMEs face in growing in Uruguay. Today, it’s satisfying to see merchants value Handy because it’s truly helping them be more efficient and boost their growth.”

Key Stats: As of 2023, Handy served over 20,000 merchants and projects closing 2024 with 30,000, which would involve processing over 1 billion dollars.

Challenges: Handy faces a rapidly growing demand from SMEs and needs to scale its cloud infrastructure to handle increasing transaction volumes while maintaining performance, security, and regulatory compliance.

Pyxis’s Role in Cloud Transformation:

AWS Infrastructure Development: Since 2021, Pyxis has partnered with Handy, supporting and operating an AWS infrastructure that prepared and positioned Handy for rapid scale and acquisition, supporting its growth among SMEs. Pyxis teams took co-ownership of an existing AWS Infrastructure and has helped design and implement new features for the AWS-based infrastructure optimized for the unique requirements of digital payments.

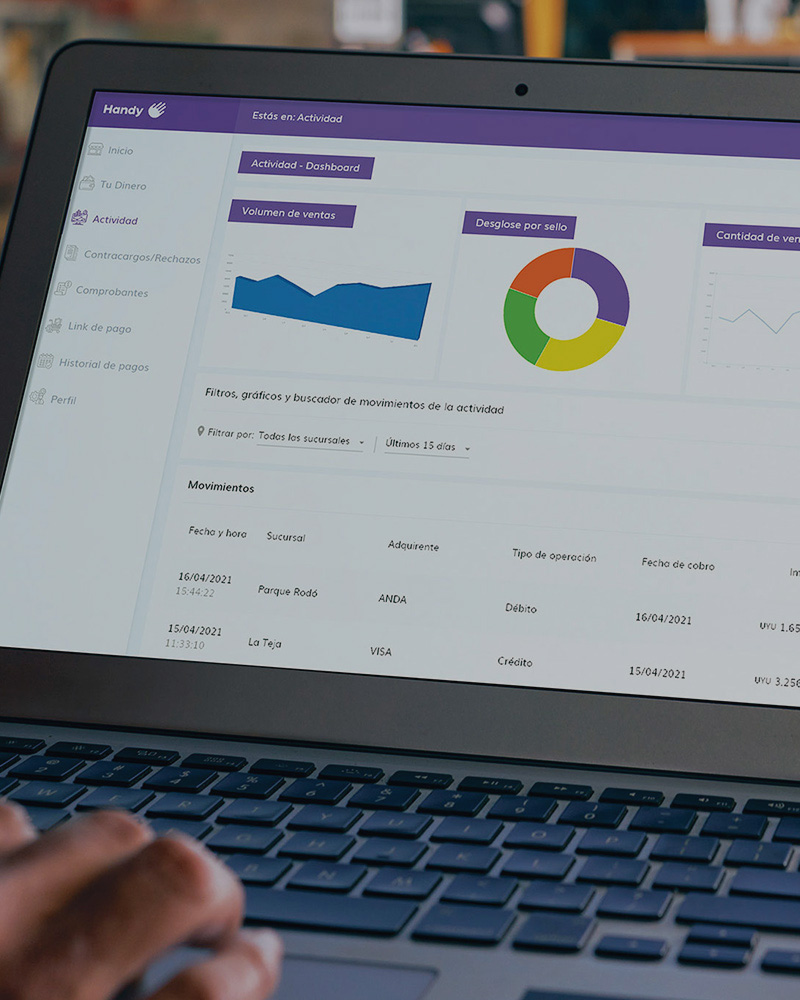

This setup provides scalability, security, and compliance, allowing Handy to process real-time transactions with robust data integrity and regulatory alignment. A solution for near real time and batch data analysis was also implemented by the Pyxis Teams to support critical business intelligence processes for decision making. Impact of the Transformation: This AWS-driven infrastructure has allowed Handy to handle a rapidly expanding client base and increasing transaction volumes efficiently, ensuring high performance and operational reliability.

Value for PE Portfolio Companies

Operational Efficiency: Through AWS optimization, Handy has minimized operational bottlenecks, enabling smooth and reliable transaction processing that meets the demands of a fast-growing SME customer base.

Customer Retention and Growth: Handy’s reliable and efficient payment platform has fostered strong customer loyalty and expanded its presence within the SME segment. This stability and scalability position Handy as a valuable asset within the fintech sector.

From Core Systems to Actionable Data: Pyxis helped Handy scale its core systems and leverage transaction data to drive business insights. Real-time analytics empower Handy and its clients with actionable insights, supporting data-driven decisions and enhancing the value delivered to SME customers.