Paigo

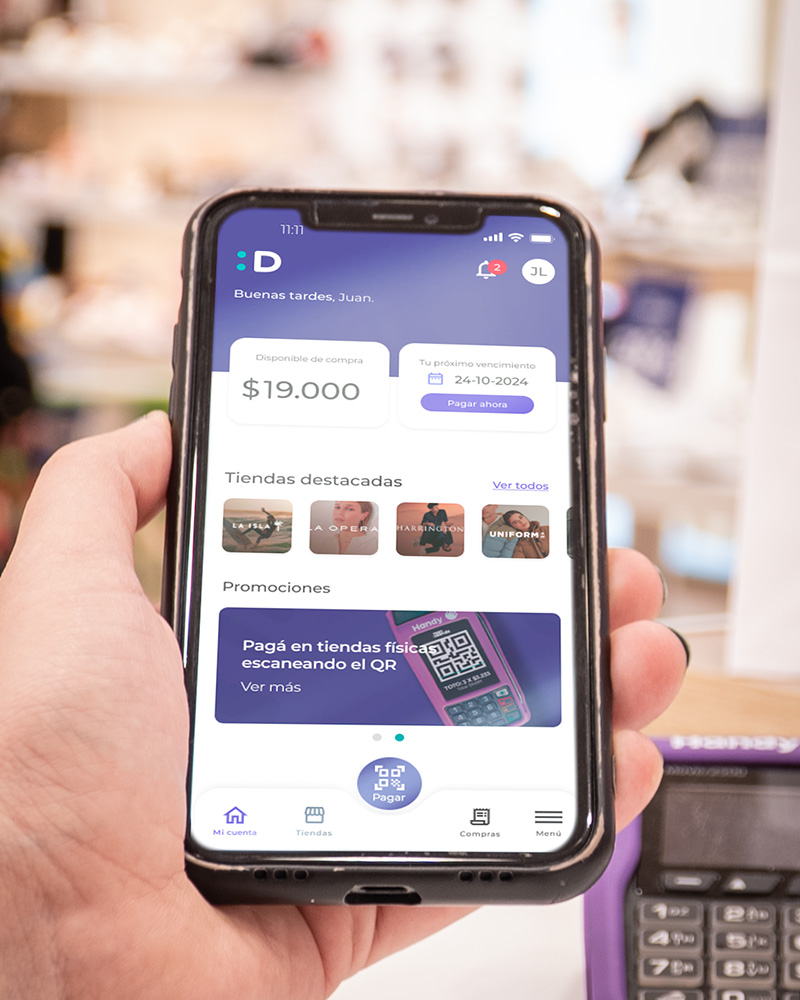

Paigo, a fintech company based in Uruguay, is a pioneer in providing 100% digital customer credit solutions tailored to small and medium-sized enterprises (SMEs).

Founded by the Uruguayan investment fund InCapital in 2018 with an $8 million investment, Paigo has grown into a key player in the digital payments sector. Its offerings include innovative features such as "Buy Now, Pay Later," enabling both consumers and businesses to manage credit efficiently while fostering financial inclusion.

Key Milestones: Paigo serves thousands of SMEs and consumers, managing financial products such as Pago Después, Crédito Uruguayo, Uin Uin, and others. Expanding beyond Uruguay, Paigo operates in Argentina and plans to enter markets in Peru and Paraguay. Its 2022 integration into Riverty, part of Arvato Financial Solutions, underscores its evolution into a global fintech brand.

Challenges: With rapid growth and a high demand for digital credit services, Paigo faced challenges in scaling its operations, ensuring secure and compliant transactions, and maintaining performance amidst increasing transaction volumes.

Pyxis’s Role in Cloud Transformation:

Cloud-Native Infrastructure Development: Since 2021, Pyxis has been a critical partner in Paigo’s digital transformation journey, evolving and maintaining a 100% cloud-native infrastructure on AWS. This architecture ensures scalability, reliability, and high availability, enabling Paigo to handle real-time credit approvals and manage increasing transaction volumes seamlessly.

Optimized Cloud Operations: Pyxis evolved and improved an AWS-based system tailored for digital credit solutions. The setup includes robust data management capabilities, allowing Paigo to deliver secure and compliant services while offering dynamic, user-friendly credit solutions like "Buy Now, Pay Later."

Data-Driven Decision Making: Pyxis integrated advanced analytics tools to process transaction data in batch. These solutions enable Paigo to generate actionable insights for better decision-making, empowering SMEs and consumers alike with data-driven financial strategies.

Impact of the Transformation

Enhanced Scalability and Performance: Pyxis’s cloud-native solutions allow Paigo to scale rapidly, meeting the growing demand for digital credit services without compromising on speed, reliability, or security.

Operational Efficiency: Optimized workflows and automated processes have minimized bottlenecks, ensuring smooth, high-speed operations that enhance the user experience for SMEs and individual customers.

Innovation in Credit Solutions: The advanced analytics capabilities provided by Pyxis have empowered Paigo to innovate its product offerings, such as flexible payment options and customized credit solutions, further cementing its position in the fintech market.

Value for Private Equity (PE) Portfolio Companies

Future-Ready Infrastructure:

Paigo’s 100% cloud-native foundation positions it as a scalable and reliable asset, ready to adapt to future technological advancements and market demands.

Operational Excellence and Growth:

The operational efficiencies driven by Pyxis enhance Paigo’s value proposition, enabling it to capture new markets and expand its customer base across Latin America.

Data-Driven Growth Strategies:

With Pyxis’s support, Paigo has leveraged data analytics to create smarter financial products, enhancing customer retention and fostering long-term growth in the competitive fintech landscape.