The Road to Value Creation

We are a boutique tech services firm. We help Private Equity Firms drive transformation in Portfolio Companies through innovative digital solutions

Value of Digital Investments - Higher valuation multiples

Business Impact comes from Tech

If you are a PE firm that

Believes that advanced analytics enable smarter decisions

Accelerates growth with AI powered insights

Utilizes real-time data to drive operational efficiency

Implements roll up strategies with your portfolio companies

Drive value creation with proven IT solutions integrator

You’ve come to the right place. Let’s take your portfolio to the next level

How our services can support your portfolio companies

Scaling Through

Cloud Solutions

- Get Started with the Cloud

-

Quickly migrate existing infrastructure to the cloud or build cloud-native systems from scratch to unlock cost efficiencies, enhance scalability, and drive performance—all with minimal disruption.

Objetive: Establish a stable, scalable, and future-ready cloud foundation that supports both immediate needs and long-term innovation.

SAMPLE USE CASES:

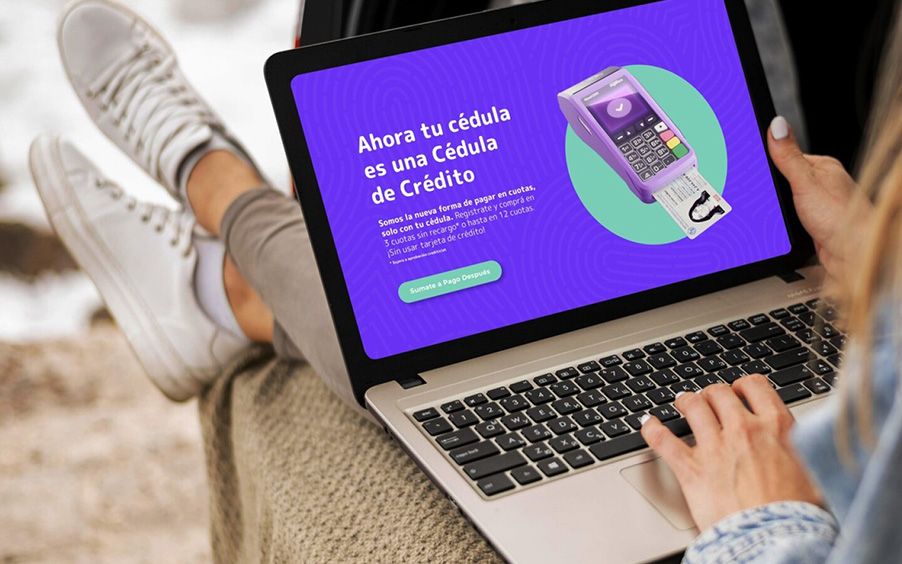

Fintech Payment Provider Bank

Fintech

A fintech company transitions its transaction processing to a cloud platform, which cuts infrastructure costs and enhances system scalability, allowing for faster transaction times and a seamless user experience.

Payment Provider

A payment provider shifts its payment processing and fraud detection systems to the cloud, achieving quicker response times and enabling real-time fraud alerts with minimal disruption, resulting in higher customer trust and improved security.

Bank

A bank migrates its account management system to the cloud, providing customers with real-time access to their information and enabling faster loan processing, which enhances customer satisfaction and operational efficiency.

- Cloud Optimization

- Cloud Evolution & Intelligence

We bring experience and a proven track record to advance portfolio companies towards success and drive value creation

Leveraging AI

for Smarter Decisions

- KPI Development and Performance Monitoring

-

Objective: Integrate and standardize data to build essential KPIs with minimal disruption to existing operations.

Key Benefits: Real-time visibility from day one for proactive decisions. Enables PE firms to track portfolio performance efficiently.

Why It Matters:Enables PE firms to track portfolio performance efficiently.

SAMPLE USE CASES:

Retail Telco Manufacturing

Retail

A retail chain achieves immediate visibility into store performance, allowing for proactive inventory management and sales optimization. A PE firm gains instant visibility into store-level performance across its retail portfolio.

Telco

A telco provider gains insights into customer behaviors, enabling data-driven retention strategies to reduce churn and boost ARPU. (Average revenue per user). PE investors receive up-to-date insights on revenue generation.

Manufacturing

Aggregate production and equipment data to measure KPIs like production efficiency and downtime, supporting productivity improvements. With real-time visibility into operational efficiency, PE firms can pinpoint areas for cost reduction and productivity gains, bolstering the value of their manufacturing investments.

- Automated Insights and AI-Driven Optimization

- Predictive Analytics and Smart Decision-Making

Let’s work together to get your portfolio companies’ house in order, freeing them to focus on growth while we handle essential backbone systems

Your Right-Hand in

Digital, Data & AI Strategy

- Digital & Data Infrastructure Assessment (Pre-Due Diligence)

-

Objective: Review digital and data infrastructure to assess risks, scalability, and alignment with business goals.

Key Benefits: Identify technical and data-related bottlenecks, ensure compliance, and uncover cost-saving opportunities, evaluating if digital and data systems support growth.

Why It Matters: As your digital right hand, this essential pre-due-diligence step addresses IT and data risks early, enabling smarter investment decisions.

SAMPLE USE CASES:

Fintech

Fintech

A PE firm is considering investing in a fintech company specializing in mobile payments. The IT infrastructure assessment reveals that the company’s payment processing systems are not scalable enough to handle future growth in user transactions, and the security protocols are not compliant with updated financial regulations. This insight helps the PE firm plan for necessary upgrades post-investment.

- AI-Driven Optimization and Modernization (Due Diligence/Acquisition or Post-Acquisition Phase)

Why Pyxis?

Fintech, Banking, Retail, Manufacturing & Telco

Proven Reputation in the Region

We Process Transactions for all the Major Credit Cards in Uruguay

Customer Base: Latam, USA & Canada

Case Studies:

80% of Private Equity leaders say mature digital investment opportunities at portfolio companies drive value

About Pyxis

With deep expertise across a wide range of industries and a team of over 250 engineers, we provide end-to-end digital solutions that solve everyday challenges and drive transformation for medium and large-sized organizations, including PE-owned companies, across diverse sectors

Private equity firms often streamline the operations of portfolio companies, but cost-cutting isn't the only road to efficiency. The right technology improvements can increase the value of PE investments.

We are seeing a sea change in how PE firms believe they can generate the highest returns for their investors, and data and digital are at the heart of this change.